-

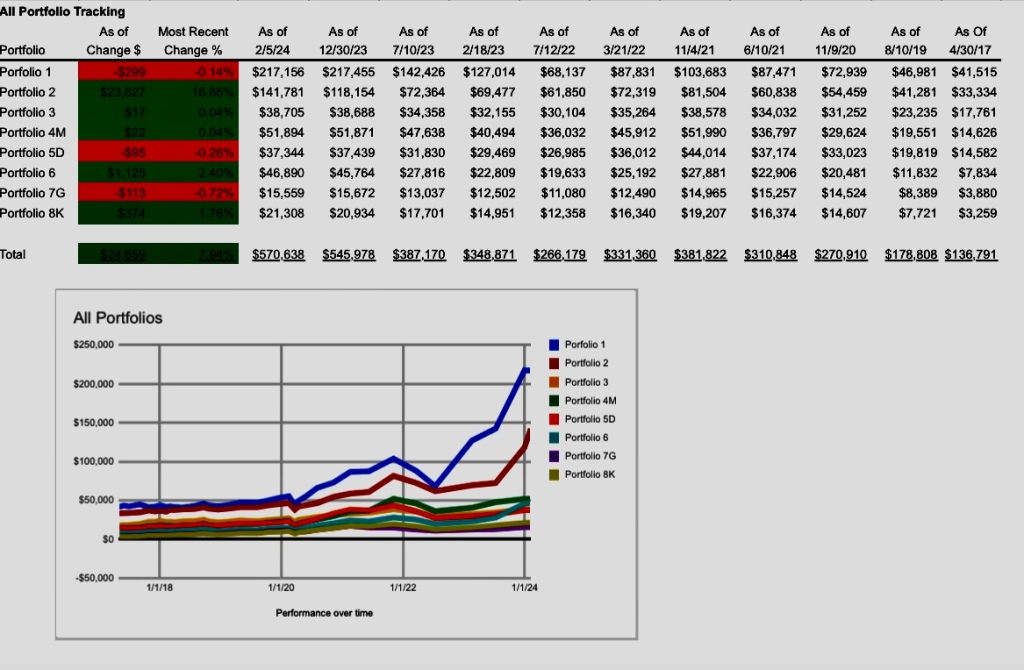

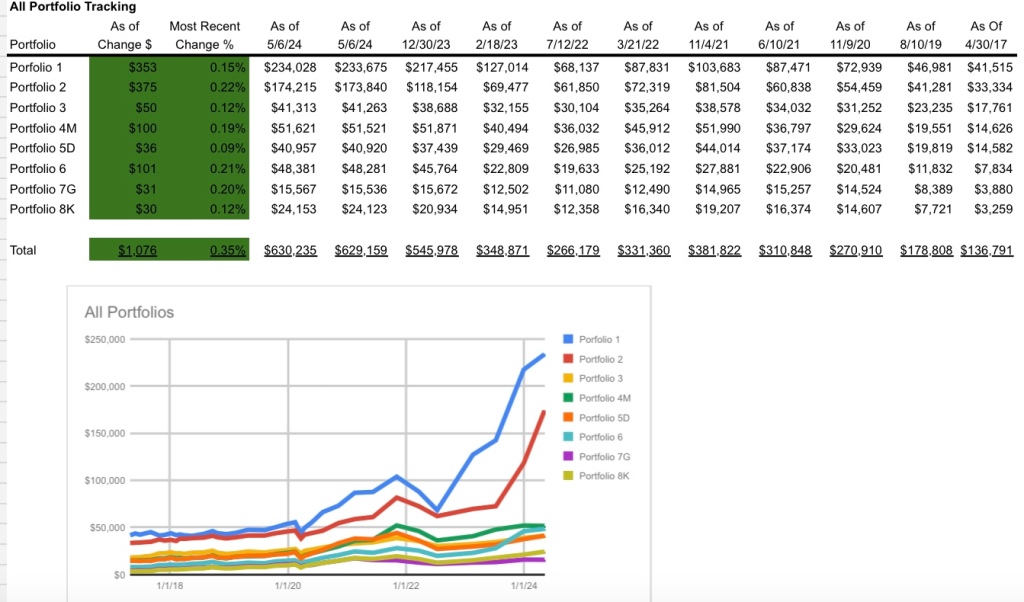

All Portfolio Update May 2024

Overall The stocks in these portfolios overall have been doing well alongside the overall market. The market is still heavily dominated by Technology stocks with high valuations. Cash as Hedge Short term cash currently yields 5.3%. There are significant cash positions in many of the portfolios. Portfolio Cash % of Cash 1 $53,236 23% 2… Read more

-

IRA and Roth IRA

Overview An IRA (Individual Retirement Account) or a Roth IRA should be strongly considered if you are not eligible for an employer-sponsored retirement plan such as a 401(k) (for private employers) or a 403B Plan (or some other variant) if you work for a government or public sector entity (like a hospital or university). If… Read more

-

Portfolio Five Updated December 2023

After December Purchases Portfolio five has a value of $37,439 with beneficiary contributions of $8000 and trustee contributions of $15,500 for a gain of $13,939. The portfolio is currently at $2374 or 2% in cash so is fully in the market with 18 stocks and ETF’s. There are some strong positions like Nvidia (NVDA) and… Read more

-

Portfolio Six Updated December 2023

Post Purchases Portfolio 6 has a value of $45,764 with beneficiary contributions of $19,100 and trustee contributions of $12,500 for a total gain of $14,164. The portfolio has $7051 in cash or 15% of total. There are 17 holdings plus cash with the largest holdings in QQQ (a recent purchase) and our Nvidia (NVDA) shares… Read more

-

Portfolio Two Updated December 2023

After December Purchases Below is the portfolio after December purchases. The value is $118,154 and the beneficiary contributed $64,500 and the trustee $22,200 for a gain of $31,454. The portfolio has $2814 or 2% in cash and is now almost fully invested in the market. QQQ and VTI make up over 30% of the total… Read more

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.